Multiple Choice

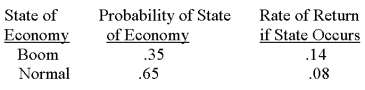

The risk-free rate is 4.15 percent. What is the expected risk premium on this stock given the following information?

A) 5.88 percent

B) 5.95 percent

C) 6.10 percent

D) 6.23 percent

E) 6.27 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: If two assets have a zero correlation,

Q11: Terry has a portfolio comprised of two

Q18: Foreign securities are generally considered to be

Q27: Which one of the following statements is

Q36: Correlation is the:<br>A)squared measure of a security's

Q62: Alicia has a portfolio consisting of two

Q69: You have a portfolio which is comprised

Q72: An investor owns a security that is

Q73: Stock A has a standard deviation of

Q75: You combine a set of assets using