Multiple Choice

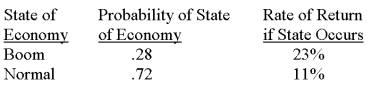

The risk-free rate is 3.15 percent. What is the expected risk premium on this stock given the following information?

A) 5.85 percent

B) 6.59 percent

C) 8.22 percent

D) 10.87 percent

E) 11.21 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Stock X has a standard deviation of

Q14: Diversification is investing in a variety of

Q31: A portfolio consists of the following securities.

Q31: Which one of the following correlation coefficients

Q32: You have a portfolio which is comprised

Q34: Rosita owns a stock with an overall

Q35: A stock fund has a standard deviation

Q37: You have a portfolio which is comprised

Q38: What is the variance of the returns

Q73: A portfolio comprised of which one of