Essay

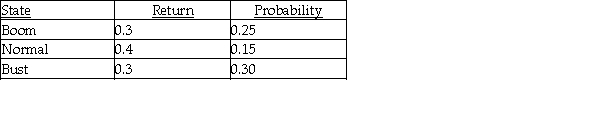

Bay Land,Inc.has the following distribution of returns:  Assuming that these returns are normally distributed,what is the probability that Bay Land,Inc.will return less than 7.25%? Show all work,and clearly explain and state your answer.

Assuming that these returns are normally distributed,what is the probability that Bay Land,Inc.will return less than 7.25%? Show all work,and clearly explain and state your answer.

Correct Answer:

Verified

Exp.Return = (.3 × .25)+ (.4 × .15)+ (.3...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Wildings,Inc.common stock has a beta of 1.2.If

Q29: A security with a beta of one

Q36: Surf and Spray Inc.has a beta equal

Q54: Marble Corp.has a beta of 2.5 and

Q76: Surf and Spray Inc.has a beta equal

Q82: Investment A has an expected return of

Q83: Wendy purchased 800 shares of Robotics Stock

Q86: Stock A has the following returns for

Q126: Diversifying among different kinds of assets is

Q150: Proper diversification generally results in the elimination