Multiple Choice

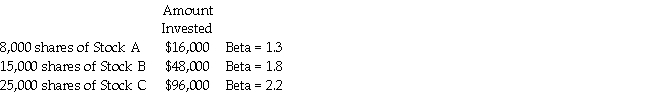

An investor currently holds the following portfolio:  The investor is worried that the beta of his portfolio is too high,so he wants to sell some stock C and add stock D,which has a beta of 1.0,to his portfolio.If the investor wants his portfolio to have a beta of 1.72,how much stock C must he replace with stock D?

The investor is worried that the beta of his portfolio is too high,so he wants to sell some stock C and add stock D,which has a beta of 1.0,to his portfolio.If the investor wants his portfolio to have a beta of 1.72,how much stock C must he replace with stock D?

A) $18,000

B) $24,000

C) $31,000

D) $36,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Beta is a measurement of the relationship

Q18: According to the CAPM,for each unit of

Q21: Which of the following is/are true?<br>A) Most

Q30: A stock with a beta of 1

Q32: Stocks that plot above the security market

Q38: As the required rate of return of

Q45: If you were to use the standard

Q91: Assume that you have $100,000 invested in

Q99: Negative historical returns are not possible during

Q149: Assume that an investment is forecasted to