Multiple Choice

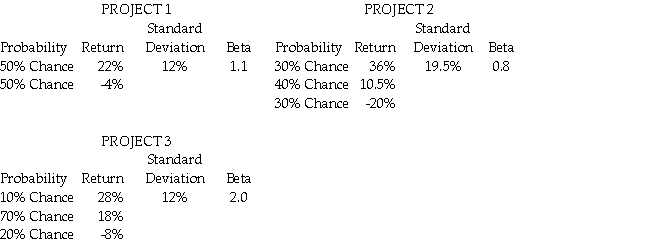

You are going to add one of the following three projects to your already well-diversified portfolio.  Assume the risk-free rate of return is 2% and the market risk premium is 8%.If you are a risk averse investor,which project should you choose?

Assume the risk-free rate of return is 2% and the market risk premium is 8%.If you are a risk averse investor,which project should you choose?

A) Project 1

B) Project 2

C) Project 3

D) Either Project 2 or Project 3 because the higher expected return on project 3 offsets its higher risk.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Adding stocks to a bond portfolio will

Q46: How can investors reduce the risk associated

Q56: Assume that you expect to hold a

Q112: Variation in the rate of return of

Q125: You are considering a sales job that

Q127: You are considering a security with the

Q128: You hold a portfolio made up of

Q130: The relevant variable a financial manager uses

Q141: Unique security risk can be eliminated from

Q147: Investment A has an expected return of