Essay

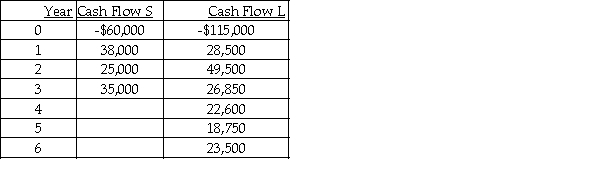

The Meacham Tire Company is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.  The required rate of return on these projects is 14 percent.What decision should be made? As part of your answer,calculate the NPV assuming a replacement chain for Project S,and also calculate the equivalent annual annuity for each project.

The required rate of return on these projects is 14 percent.What decision should be made? As part of your answer,calculate the NPV assuming a replacement chain for Project S,and also calculate the equivalent annual annuity for each project.

Correct Answer:

Verified

Accept Project S because its replacement...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Lithium,Inc.is considering two mutually exclusive projects,A and

Q25: A significant advantage of the payback period

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2783/.jpg" alt=" The Internal Rate

Q47: One of the disadvantages of the payback

Q49: The profitability index provides an advantage over

Q106: If a firm imposes a capital constraint

Q117: When capital rationing exists,the divisibility of projects

Q126: Both the profitability index (PI)and net present

Q137: A project's net present value profile shows

Q154: What is the payback period for a