Essay

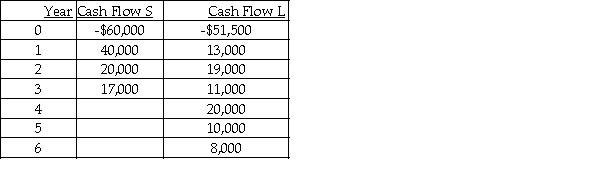

The Dickerson PR Firm is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.  Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Correct Answer:

Verified

Choose Project S.Although the NPV of Pro...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Any project deemed acceptable using the discounted

Q18: The Bolster Company is considering two mutually

Q32: Two projects that have the same cost

Q38: DYI Construction Co.is considering a new inventory

Q76: The Net Present Value (or NPV)criteria for

Q110: You are considering investing in a project

Q115: A one-sign-reversal project should be accepted if

Q143: Kingston Corp.is considering a new machine that

Q144: Consider two mutually exclusive projects X and

Q148: The profitability index can be helpful when