Essay

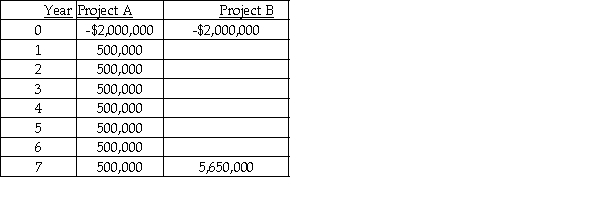

Company K is considering two mutually exclusive projects.The cash flows of the projects are as follows:

a.Compute the NPV and IRR for the above two projects,assuming a 13% required rate of return.

b.Discuss the ranking conflict.

c.What decision should be made regarding these two projects?

Correct Answer:

Verified

a.NPV of A = $211,305 NPV of B = $401,59...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: The Bolster Company is considering two mutually

Q27: Your company is considering a project with

Q28: Lithium,Inc.is considering two mutually exclusive projects,A and

Q35: If a project has multiple internal rates

Q53: Your firm is considering an investment that

Q72: DYI Construction Co.is considering a new inventory

Q76: The Net Present Value (or NPV)criteria for

Q110: You are considering investing in a project

Q136: Free cash flows represent the benefits generated

Q148: The profitability index can be helpful when