Essay

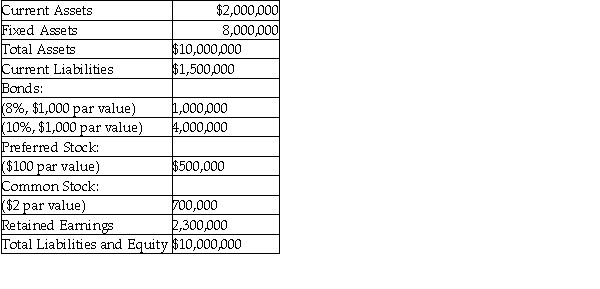

The MAX Corporation is planning a $4,000,000 expansion this year.The expansion can be financed by issuing either common stock or bonds.The new common stock can be sold for $60 per share.The bonds can be issued with a 12 percent coupon rate.The firm's existing shares of preferred stock pay dividends of $2.00 per share.The company's corporate income tax rate is 46 percent.The company's balance sheet prior to expansion is as follows: MAX Corporation  a.Calculate the indifference level of EBIT between the two plans.

a.Calculate the indifference level of EBIT between the two plans.

b.If EBIT is expected to be $3 million,which plan will result in higher EPS?

Correct Answer:

Verified

a.

b.EPS: Stock Pl...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.EPS: Stock Pl...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: All of the following will make the

Q49: Because financial markets can be extremely volatile,with

Q61: Basic tools of capital-structure management include<br>A) EBIT-EPS

Q84: Capital structure is the mix of the

Q93: Operating leverage is measured as the responsiveness

Q103: Kohler Manufacturing typically achieves one of three

Q115: One component of a firm's financial structure

Q127: A Bristal Boats,Inc.reports sales of $4,000,000,variable costs

Q132: A key tool for evaluating business risk

Q142: In break-even analysis,semivariable costs are segregated into