Essay

Silver Prices

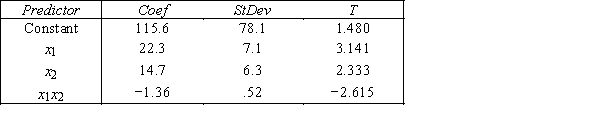

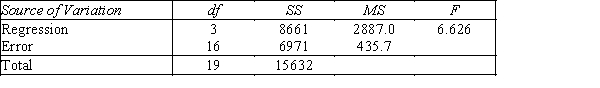

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Is there sufficient evidence at the 1% significance level to conclude that the price of a barrel of oil and the price of silver are linearly related?

Correct Answer:

Verified

H0: β1 = 0 vs.H1: β1≠ 0 Rejection region: | ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: The model y = β<sub>0</sub> + β<sub>1</sub>x<sub>1</sub>

Q64: Motorcycle Fatalities<br> A traffic consultant has analyzed

Q65: Senior Medical Students<br> A professor of

Q66: Senior Medical Students<br> A professor of

Q67: Color of truck is a(n)_ variable.

Q69: In stepwise regression the dependent variable must

Q70: The independent variable x in a polynomial

Q71: Senior Medical Students<br> A professor of

Q72: Silver Prices<br> An economist is in the

Q73: A logistic regression equation is <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4388/.jpg"