Multiple Choice

Use the following information to answer the following questions.

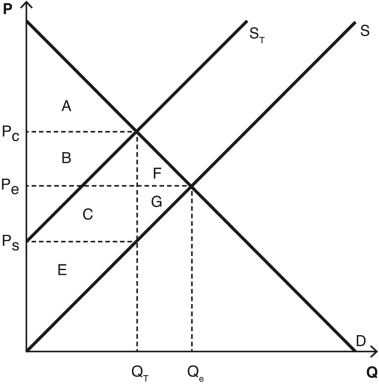

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-Which areas represent producer surplus after the tax is imposed?

A) E + C + G

B) E + C

C) E + G

D) F + G

E) E

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The revenue generated from a tax equals

Q4: A tax on apples would cause consumers

Q5: When looking at a supply and demand

Q6: A tax on consumers would cause the

Q7: Deadweight loss is defined as<br>A) the cost

Q9: Use the following information to answer the

Q10: A tax on milk would likely cause

Q11: A(n)_ in the elasticity of supply or

Q12: The incidence of a tax is unrelated

Q13: In the long run,both supply and demand