Multiple Choice

Use the following information to answer the following questions.

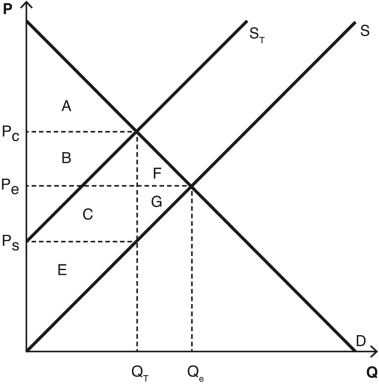

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-What is the total amount of producer and consumer surplus (i.e. ,social welfare) in this market before the tax is imposed?

A) A + B + C + E + F + G

B) A + C

C) A + B + C + E

D) F + G

E) B + C+ F + G

Correct Answer:

Verified

Correct Answer:

Verified

Q19: A tax on apples would cause the

Q20: Holding all else constant,when the price of

Q21: A tax creates no deadweight loss only

Q22: Priscilla is willing to pay $65 for

Q23: What makes an excise tax an especially

Q25: Draw a set of supply and demand

Q26: After a tax is imposed,the price paid

Q27: Gasoline and ethanol are substitute fuels.If the

Q28: Use a figure with intersecting supply and

Q29: Taxes cause consumers to lose consumer surplus