Multiple Choice

Use the following information to answer the following questions.

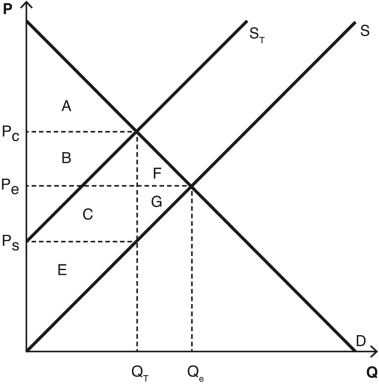

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-Which areas represent the revenue collected from this tax?

A) A + B + F

B) B + C

C) F + G

D) E

E) A + E

Correct Answer:

Verified

Correct Answer:

Verified

Q155: Compared to consumers,producers will lose the lesser

Q156: Of the following items,which is/are most important

Q157: Taxing goods with very inelastic supply generates

Q158: If the demand for bread is more

Q159: If a tax is imposed on a

Q161: An annual subscription for ECONO! magazine costs

Q162: In the long run,both supply and demand

Q163: In a small town,the market price for

Q164: Explain the difference between the burden of

Q165: When a good with equally elastic demand