Essay

John and Susan file a joint income tax return for 2018.They have two dependent children, students, ages 19 and 20.John earns wages of $908,000 and John and Susan have interest income of $102,000.In 2018, they settle a state tax audit and pay $50,000 for back state taxes due to an overly aggressive tax-sheltered investment.Their other expenses for the year include:

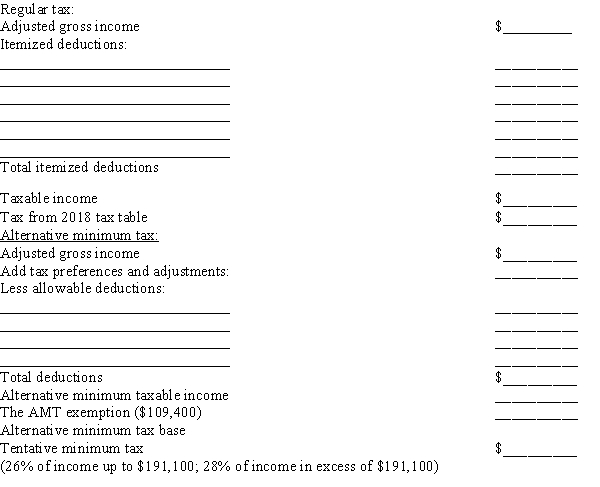

a.Calculate John and Susan's 2018 regular tax and tentative minimum tax on the schedule provided.

b.How much is the total tax liability shown on John and Susan's 2018 Form 1040?

Correct Answer:

Verified

_TB6300_00_TB6300_00...

_TB6300_00_TB6300_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: The hybrid method of accounting involves the

Q37: Emily is a self-employed attorney.<br>a.Assuming that Emily

Q38: Countryside Acres Apartment Complex had the

Q39: In 2018, which of the following children

Q40: Which of the following is true with

Q41: The 0.9 percent Medicare tax applies to:<br>A)Earned

Q43: Net unearned income of certain minor children

Q44: Lucinda is a self-employed veterinarian in 2018.Her

Q45: ABC Corporation is owned 30 percent by

Q47: Karen is single and earns wages of