Multiple Choice

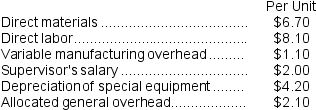

Norgaard Corporation makes 8,000 units of part G25 each year.This part is used in one of the company's products.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $21.20 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $2,000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part G25 would be used to make more of one of the company's other products, generating an additional segment margin of $16,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part G25 from the outside supplier should be:

An outside supplier has offered to make and sell the part to the company for $21.20 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $2,000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part G25 would be used to make more of one of the company's other products, generating an additional segment margin of $16,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part G25 from the outside supplier should be:

A) ($8,400)

B) $16,000

C) ($8,000)

D) ($40,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q19: When a company has a production constraint,

Q49: Farrugia Corporation produces two intermediate products,A and

Q85: Hodge Inc.has some material that originally cost

Q149: The constraint at Rauchwerger Corporation is time

Q175: Otool Inc.is considering using stocks of an

Q185: The Draper Corporation is considering dropping its

Q326: Fixed costs may be relevant in a

Q350: Companies often allocate common fixed costs among

Q396: The variable costs of a product are

Q408: Sunk costs and future costs that do