Multiple Choice

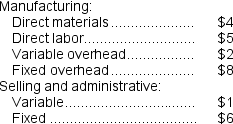

The following are Silver Corporation's unit costs of making and selling an item at a volume of 8,000 units per month (which represents the company's capacity) :

Present sales amount to 7,000 units per month. An order has been received from a customer in a foreign market for 1,000 units. The order would not affect regular sales. Total fixed costs, both manufacturing and selling and administrative, would not be affected by this order. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume that direct labor is a variable cost.

Present sales amount to 7,000 units per month. An order has been received from a customer in a foreign market for 1,000 units. The order would not affect regular sales. Total fixed costs, both manufacturing and selling and administrative, would not be affected by this order. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume that direct labor is a variable cost.

-What is the financial advantage (disadvantage) for the company from this special order if it prices the 1,000 units at $20 per unit?

A) $1,000

B) $9,000

C) ($6,000)

D) $8,000

Correct Answer:

Verified

Correct Answer:

Verified

Q27: A complete income statement need not be

Q61: Ouzts Corporation is considering Alternative A and

Q62: Juliani Company produces a single product.The cost

Q63: Drew Cane Products,Inc.,processes sugar cane in batches.The

Q67: The constraint at Rauchwerger Corporation is time

Q68: Saalfrank Corporation is considering two alternatives that

Q70: Dock Corporation makes two products from a

Q71: Cybil Baunt just inherited a 1958 Chevy

Q71: Faustina Chemical Corporation manufactures three chemicals (TX14,NJ35,and

Q88: The opportunity cost of making a component