Multiple Choice

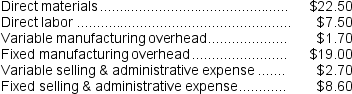

Elfalan Corporation produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 80,000 units per month is as follows:

The normal selling price of the product is $67.80 per unit.

The normal selling price of the product is $67.80 per unit.

An order has been received from an overseas customer for 3,000 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $1.90 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

-Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is $60.60 per unit.The monthly financial advantage (disadvantage) for the company as a result of accepting this special order should be:

A) ($4,200)

B) $84,300

C) ($15,900)

D) $27,300

Correct Answer:

Verified

Correct Answer:

Verified

Q38: The Wester Corporation produces three products with

Q39: Norgaard Corporation makes 8,000 units of part

Q44: Supler Corporation produces a part used in

Q46: Younes Inc. manufactures industrial components. One of

Q47: A customer has asked Lalka Corporation to

Q48: Gordon Corporation produces 1,000 units of a

Q60: Opportunity costs represent costs that can be

Q112: A joint product is:<br>A) any product which

Q157: The Freed Corporation produces three products, X,

Q258: It may be a good decision to