Essay

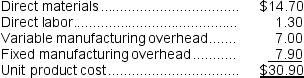

A customer has asked Lalka Corporation to supply 3,000 units of product H60, with some modifications, for $34.70 each.The normal selling price of this product is $46.35 each.The normal unit product cost of product H60 is computed as follows:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product H60 that would increase the variable costs by $3.80 per unit and that would require a one-time investment of $24,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product H60 that would increase the variable costs by $3.80 per unit and that would require a one-time investment of $24,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Required:

Determine the financial advantage or disadvantage of accepting the special order.Show your work!

Correct Answer:

Verified

Correct Answer:

Verified

Q36: The Carter Corporation makes products A and

Q43: Elfalan Corporation produces a single product. The

Q97: The Carter Corporation makes products A and

Q193: Garson, Inc.produces three products.Data concerning the selling

Q195: WP Corporation produces products X, Y, and

Q199: The SP Corporation makes 40,000 motors to

Q202: Part S51 is used in one of

Q203: Danny Dolittle makes crafts in his spare

Q282: A disadvantage of vertical integration is that

Q297: Priddy Corporation processes sugar cane in batches.