Multiple Choice

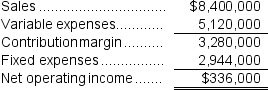

Tadman Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales.

At the beginning of this year, the company has a $800,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $756,000, and a contribution margin ratio of 30% of sales.

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 1.0%

B) 3.0%

C) 5.0%

D) 3.8%

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Dacker Products is a division of a

Q77: Weafer Inc. reported the following results from

Q106: Financial measures such as ROI and residual

Q112: Which of the following will increase a

Q113: Ibale Industries is a division of a

Q115: Condren Inc.reported the following results from last

Q116: The following data has been provided for

Q119: Othman Inc.has a $800,000 investment opportunity with

Q151: If improvement in a performance measure on

Q225: Haney Fabrication is a division of a