Multiple Choice

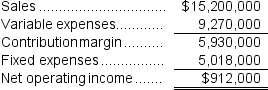

Wiswell Inc.reported the following results from last year's operations:  The average operating assets were $8,000,000.

The average operating assets were $8,000,000.

At the beginning of this year, the company has a $900,000 investment opportunity that would involve sales of $2,070,000, a contribution margin ratio of 30% of sales, and fixed expenses of $538,200.The company's minimum required rate of return is 10%.If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

A) $104,800

B) $925,600

C) ($19,800)

D) $994,800

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Serie Inc. reported the following results from

Q38: If the balanced scorecard is correctly constructed,

Q50: Gauntlett Inc. reported the following results from

Q71: Worley Inc.reported the following results from last

Q73: Pinkton Corporation keeps careful track of the

Q130: Financial measures tend to be lag indicators

Q150: The following data are for the Akron

Q164: Rotan Corporation keeps careful track of the

Q167: When used in return on investment (ROI)

Q168: Cabell Products is a division of a