Multiple Choice

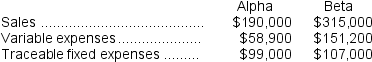

Combe Corporation has two divisions: Alpha and Beta.Data from the most recent month appear below:  The company's common fixed expenses total $80,800.The break-even in sales dollars for Alpha Division is closest to:

The company's common fixed expenses total $80,800.The break-even in sales dollars for Alpha Division is closest to:

A) $491,129

B) $143,478

C) $187,536

D) $260,580

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Absorption costing treats all manufacturing costs as

Q70: Smidt Corporation has provided the following data

Q97: Helmers Corporation manufactures a single product. Variable

Q109: Janos Corporation, which has only one product,

Q118: Wyrich Corporation has two divisions: Blue Division

Q118: When using segmented income statements, the dollar

Q125: Muckleroy Corporation has two divisions: Division K

Q231: Plummer Corporation has provided the following data

Q250: Moskowitz Corporation has provided the following data

Q276: Beach Corporation, which produces a single product,