Essay

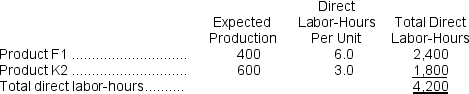

Brayman, Inc., manufactures and sells two products: Product F1 and Product K2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $28.30 per DLH.The direct materials cost per unit is $148.60 for Product F1 and $192.70 for Product K2.

The direct labor rate is $28.30 per DLH.The direct materials cost per unit is $148.60 for Product F1 and $192.70 for Product K2.

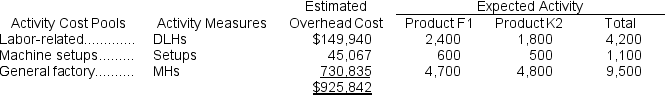

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

Determine the unit product cost of each product under the activity-based costing method.

Correct Answer:

Verified

Computation of activity rates:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Overhead allocation based solely on a measure

Q79: Senff Corporation uses the following activity rates

Q81: If the company allocates all of its

Q82: Deveney, Inc., manufactures and sells two products:

Q83: The overhead applied to each unit of

Q85: Foisy, Inc., manufactures and sells two products:

Q86: Moyle Corporation has provided the following data

Q87: Chrzan, Inc., manufactures and sells two products:

Q88: Gelinas, Inc., manufactures and sells two products:

Q89: The activity rate for the Labor-Related activity