Essay

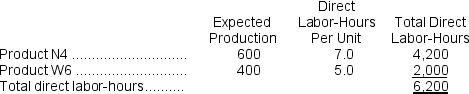

Vescovi, Inc., manufactures and sells two products: Product N4 and Product W6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $16.20 per DLH.The direct materials cost per unit for each product is given below:

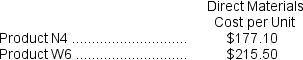

The direct labor rate is $16.20 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

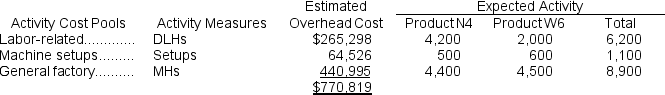

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

What is the difference between the unit product costs under the traditional costing method and the activity-based costing system for each of the two products?

Correct Answer:

Verified

Predetermined overhead rate = Estimated ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: Privott, Inc., manufactures and sells two products:

Q112: In activity-based costing, unit product costs computed

Q113: The activity rate for the Labor-Related activity

Q114: The unit product cost of Product A4

Q115: The overhead applied to each unit of

Q117: The overhead applied to each unit of

Q118: Parts administration is an example of a:<br>A)Unit-level

Q119: Graise, Inc., manufactures and sells two products:

Q120: The unit product cost of Product Q9

Q121: If the materials handling cost is allocated