Essay

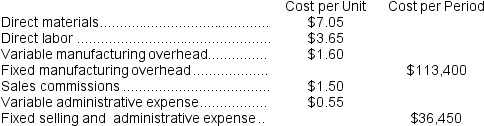

Dobosh Corporation has provided the following information:  Required:

Required:

a.For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?

b.For financial reporting purposes, what is the total amount of period costs incurred to sell 9,000 units?

c.If 10,000 units are sold, what is the variable cost per unit sold?

d.If 10,000 units are sold, what is the total amount of variable costs related to the units sold?

e.If 10,000 units are produced, what is the total amount of manufacturing overhead cost incurred?

f.If the selling price is $21.60 per unit, what is the contribution margin per unit sold?

g.If 8,000 units are produced, what is the total amount of direct manufacturing cost incurred?

h.If 8,000 units are produced, what is the total amount of indirect manufacturing costs incurred?

i.What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

Correct Answer:

Verified

a.  _TB2627_00 b.

_TB2627_00 b.  _TB2627_00 c....

_TB2627_00 c....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: To the nearest whole dollar,what should be

Q16: A contribution format income statement separates costs

Q30: Schwiesow Corporation has provided the following information:<br>

Q36: Kesterson Corporation has provided the following information:<br>

Q64: Within the relevant range, a change in

Q73: Macy Corporation's relevant range of activity is

Q74: Saxbury Corporation's relevant range of activity is

Q167: A partial listing of costs incurred at

Q266: Although the traditional format income statement is

Q296: A partial listing of costs incurred at