Multiple Choice

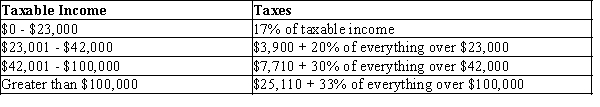

-Use the information provided in Exhibit 11-4.What is the marginal tax rate on the 42,001st dollar of taxable income earned?

A) 17%

B) 20%

C) 30%

D) 33%

E) There is not enough information provided to answer this question.

Correct Answer:

Verified

Correct Answer:

Verified

Q104: Describe the fiscal policy remedies that a

Q105: According to the textbook (based upon 2014

Q106: At a taxable income of $50,000 Mari's

Q107: Explain the difference between a progressive income

Q108: If an economist recommends that the government

Q110: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6439/.jpg" alt=" -Refer to Exhibit

Q111: A tax rate increase always leads to

Q112: The United States currently has a progressive

Q113: The economy is in a recessionary gap.There

Q114: At a taxable income of $120,000 Adam's