Multiple Choice

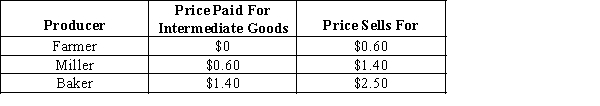

-Refer to Exhibit 11-5 which summarizes the situation prior to the value added tax (VAT) .If the government imposes a VAT rate of 10 percent,the baker must pay ___________ in VAT tax and will need to raise the price he charges the final consumer to _______________.

A) $0.06; $2.25

B) $0.11; $2.75

C) $0.25; $2.75

D) $0.60; $2.57

Correct Answer:

Verified

Correct Answer:

Verified

Q153: To identify whether fiscal policy is expansionary

Q154: Senator Smith proposes that the income tax

Q155: Explain how a value-added tax (VAT)works and

Q156: Based upon information provided in the textbook,in

Q157: A value-added tax (VAT)is a less visible

Q159: As a result of an increase in

Q160: The answer is: "Policymakers are not aware

Q161: Reductions in private spending as a result

Q162: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6439/.jpg" alt=" -Refer to Exhibit

Q163: Suppose the economy's current AD and SRAS