Multiple Choice

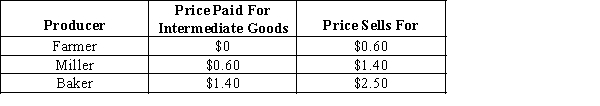

-Refer to Exhibit 11-5 which summarizes the situation prior to the value added tax (VAT) .If the government imposes a VAT rate of 10 percent,the government will receive ___________ in VAT revenue per loaf of bread sold and the final consumer will find that he has to pay _______________ more for a loaf of bread than he did prior to the VAT tax.

A) $0.25; $2.53

B) $0.11; $2.75

C) $0.25; $0.25

D) $0.03; $2.75

Correct Answer:

Verified

Correct Answer:

Verified

Q55: If company Z is receiving a government

Q56: The economy is in a recessionary gap,there

Q57: To eliminate an inflationary gap,Keynesian theory indicates

Q58: According to Keynesian theory,a recessionary gap can

Q59: The transmission lag is the time between<br>A)

Q61: When the government decides to increase income

Q62: What are the two types of discretionary

Q63: The economy is in a recessionary gap,wages

Q64: Which of the following illustrates the wait-and-see

Q65: Suppose Congress increases income taxes.This is an