Essay

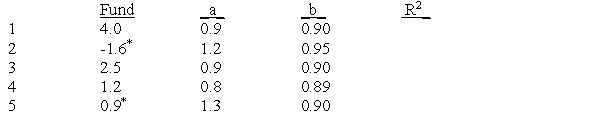

Consider the five funds shown below:

*Significant at the 5 percent level

a.Which fund's returns are best explained by the market's returns?

a.Which fund's returns are best explained by the market's returns?

b Which fund had the largest total risk?

c.Which fund had the lowest market risk? The highest?

d.Which fund(s),according to Jensen's alpha,outperformed the market?

Correct Answer:

Verified

(a)Fund 2.It has the highest R2. (b)Stand...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: The _ indicates the percentage of the

Q8: Which of the following indices would be

Q9: The reward-to-volatility ratio measures the excess return

Q12: The reward-to-variability ratio measures:<br>A)return above the risk-free

Q13: The --------------------- is the legitimate alternative to

Q15: Jensen's alpha measures the contribution of the

Q16: Which of the following is true regarding

Q17: Modigliani-squared is a return adjusted for volatility

Q51: The purpose of performance attribution is to

Q66: The time-weighted rate of return is affected