Multiple Choice

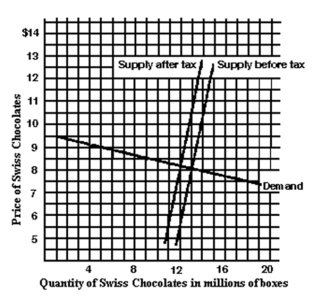

-About how much of the tax is paid by consumers in the form of higher prices?

A) 20 cents

B) 50 cents

C) $1

D) $4.85

E) $5

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q88: When the inelasticities of demand and supply

Q89: If elasticity of demand is 4 and

Q90: If the federal excise tax on cigarettes

Q91: If demand and supply have the same

Q92: If price were lowered from $10 to

Q94: A demand curve that is perfectly horizontal

Q95: Assume the Cookie Monster,who eats only cookies,has

Q96: If the elasticity of demand for a

Q97: If more substitutes become available demand tends

Q98: If elasticity of demand is 10,a 1%