Multiple Choice

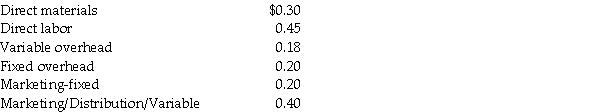

The manager at the Plymouth Manufacturing Company reported a current production level of 22,000 units per month.The managerial accountant reported the following unit-level costs:

The manager reported monthly sales of 20,000 units.The Salem Company contacted the manager at Plymouth Manufacturing and inquired about the purchase of 1,525 units at $2.10 per unit.The manager noted that current sales would not be affected by the one-time-only special order,and variable marketing/distribution costs would not be incurred with the special order.What is the change in operating profits at Plymouth Manufacturing Company's if the special order is accepted?

A) $1,525 decrease

B) $1,525 increase

C) $1,784.25 decrease

D) $1,784.25 increase

E) There is no change in operating profits

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The manager at Frame Manufacturing reported the

Q35: The manager at Elite Transportation Company is

Q36: The sum of all costs in a

Q37: The Future Manufacturing Company employed a new

Q38: How do managers determine the most profitable

Q40: Depreciation on equipment that a company has

Q41: Cost of a new machine is:<br>A)past cost.<br>B)relevant.<br>C)irrelevant.<br>D)sunk

Q42: In which step of the decision-making process

Q43: What do managers do if the performance-evaluation

Q44: There is no opportunity cost of using