Multiple Choice

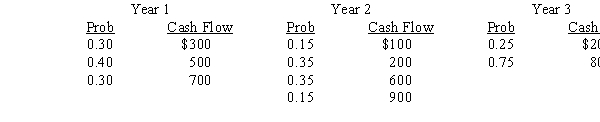

A project with a 3-year life has the following probability distributions for possible end of year cash flows in each of the next three years:  Using an interest rate of 8 percent,find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year,then evaluate those cash flows.)

Using an interest rate of 8 percent,find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year,then evaluate those cash flows.)

A) $1,204.95

B) $835.42

C) $1,519.21

D) $1,580.00

E) $1,347.61

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Alice's investment advisor is trying to convince

Q4: The coupon rate is the rate of

Q32: You expect to receive $1,000 at the

Q40: Compounding is the process of converting today's

Q72: Sarah is thinking about purchasing an investment

Q82: As the discount rate increases without limit,the

Q84: Because we usually assume positive interest rates

Q84: You plan to invest an amount of

Q107: If a 5-year regular annuity has a

Q109: A recent advertisement in the financial section