Multiple Choice

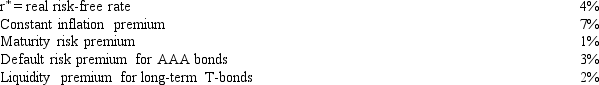

You are given the following data:  Assume that a highly liquid market does not exist for long-term T-bonds,and the expected rate of inflation is a constant.Given these conditions,the nominal risk-free rate for T-bills is __________,and the rate on long-term Treasury bonds is __________.

Assume that a highly liquid market does not exist for long-term T-bonds,and the expected rate of inflation is a constant.Given these conditions,the nominal risk-free rate for T-bills is __________,and the rate on long-term Treasury bonds is __________.

A) 4%; 14%

B) 4%; 15%

C) 11%; 14%

D) 11%; 15%

E) 11%; 17%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Investors with a higher time preference for

Q5: The normal yield curve is upward sloping

Q9: The term structure is defined as the

Q18: Assume that a 3-year Treasury note has

Q27: In 2000, Craig and Kathy Koehler owned

Q29: Your corporation has the following cash flows:

Q34: Which of the following statements is most

Q58: Your uncle would like to restrict his

Q60: Which of the following statements is correct?<br>A)

Q86: As a corporate investor paying a marginal