Multiple Choice

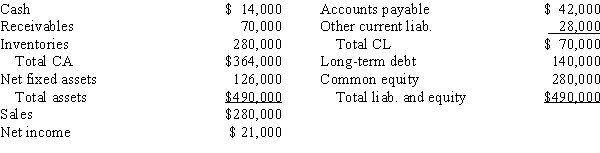

Jordan Inc has the following balance sheet and income statement data:

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.75,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change?

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.75,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change?

A) 11.26%

B) 11.85%

C) 12.45%

D) 13.07%

E) 13.72%

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Firms A and B have the same

Q85: Market value ratios provide management with an

Q121: Exhibit 4.1<br>The balance sheet and income statement

Q124: Exhibit 4.1<br>The balance sheet and income statement

Q126: Other things held constant,the more debt a

Q127: Companies HD and LD have the same

Q128: Significant variations in accounting methods among firms

Q128: Casey Communications recently issued new common stock

Q129: The more conservative a firm's management is,the

Q130: Precision Aviation had a profit margin of