Multiple Choice

Exhibit 4.1

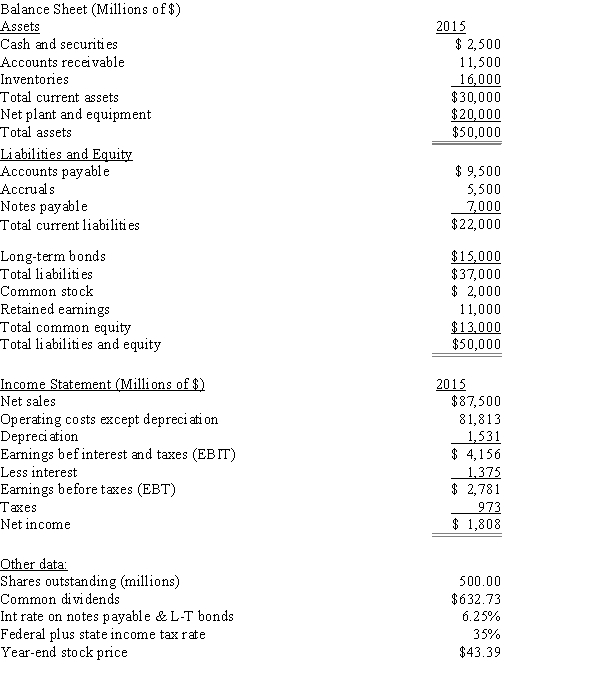

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's market-to-book ratio?

A) 0.87

B) 1.02

C) 1.21

D) 1.42

E) 1.67

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The advantage of the basic earning power

Q28: The inventory turnover ratio and days sales

Q54: The operating margin measures operating income per

Q56: River Corp's total assets at the end

Q63: The days sales outstanding tells us how

Q64: Which of the following statements is CORRECT?<br>A)Borrowing

Q65: Helmuth Inc's latest net income was $1,250,000,and

Q74: Although a full liquidity analysis requires the

Q76: Which of the following would generally indicate

Q113: The times-interest-earned ratio measures the extent to