True/False

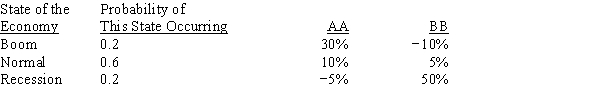

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational,risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

We can conclude from the above information that any rational,risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: Portfolio A has but one security, while

Q25: For a portfolio of 40 randomly selected

Q41: Which of the following statements is CORRECT?<br>A)

Q74: Assume that two investors each hold a

Q79: Which of the following is most likely

Q81: The tighter the probability distribution of its

Q109: Tom O'Brien has a 2-stock portfolio with

Q113: Calculate the required rate of return for

Q117: Cooley Company's stock has a beta of

Q120: Which of the following statements is CORRECT?<br>A)