Multiple Choice

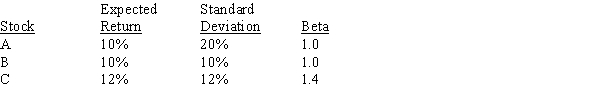

Consider the following information for three stocks,A,B,and C.The stocks' returns are positively but not perfectly positively correlated with one another,i.e.,the correlations are all between 0 and 1.  Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%,and the market is in equilibrium,so required returns equal expected returns.Which of the following statements is CORRECT?

Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%,and the market is in equilibrium,so required returns equal expected returns.Which of the following statements is CORRECT?

A) Portfolio AB has a standard deviation of 20%.

B) Portfolio AB's coefficient of variation is greater than 2.0.

C) Portfolio AB's required return is greater than the required return on Stock A.

D) Portfolio ABC's expected return is 10.66667%.

E) Portfolio ABC has a standard deviation of 20%.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A stock with a beta equal to

Q32: Bad managerial judgments or unforeseen negative events

Q63: Assume that the risk-free rate is 5%.Which

Q68: Mulherin's stock has a beta of 1.23,its

Q70: Nagel Equipment has a beta of 0.88

Q87: Which of the following statements is CORRECT?<br>A)

Q98: Stocks A,B,and C all have an expected

Q110: The realized return on a stock portfolio

Q120: A stock's beta is more relevant as

Q131: Assume that the risk-free rate,r<sub>RF</sub>,increases but the