Multiple Choice

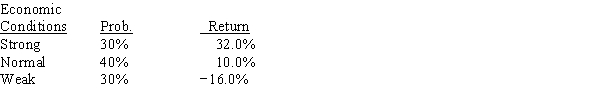

Carson Inc.'s manager believes that economic conditions during the next year will be strong,normal,or weak,and she thinks that the firm's returns will have the probability distribution shown below.What's the standard deviation of the estimated returns? (Hint: Use the formula for the standard deviation of a population,not a sample.)

A) 17.69%

B) 18.62%

C) 19.55%

D) 20.52%

E) 21.55%

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Stock A has a beta = 0.8,while

Q29: If the returns of two firms are

Q47: Stock A has a beta of 1.2

Q64: We would almost always find that the

Q117: Cooley Company's stock has a beta of

Q120: Bill Dukes has $100,000 invested in a

Q123: Under the CAPM, the required rate of

Q124: Kollo Enterprises has a beta of 1.10,the

Q125: The SML relates required returns to firms'

Q126: The slope of the SML is determined