Multiple Choice

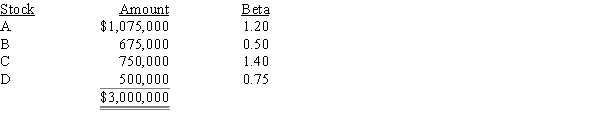

Assume that you are the portfolio manager of the SF Fund,a $3 million hedge fund that contains the following stocks.The required rate of return on the market is 11.00% and the risk-free rate is 5.00%.What rate of return should investors expect (and require) on this fund?

A) 10.56%

B) 10.83%

C) 11.11%

D) 11.38%

E) 11.67%

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The standard deviation is a better measure

Q57: If an investor buys enough stocks, he

Q78: Stock X has a beta of 0.7

Q81: Stock A has an expected return of

Q93: You observe the following information regarding Companies

Q94: Assume that to cool off the economy

Q121: A stock's beta measures its diversifiable risk

Q138: In a portfolio of three randomly selected

Q140: Dothan Inc.'s stock has a 25% chance

Q143: Your portfolio consists of $50,000 invested in