Multiple Choice

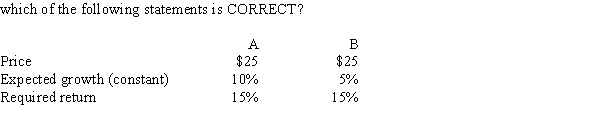

Stocks A and B have the following data.Assuming the stock market is efficient and the stocks are in equilibrium,

A) Stock A's expected dividend at t = 1 is only half that of Stock B.

B) Stock A has a higher dividend yield than Stock B.

C) Currently the two stocks have the same price, but over time Stock B's price will pass that of A.

D) Since Stock A's growth rate is twice that of Stock B, Stock A's future dividends will always be twice as high as Stock B's.

E) The two stocks should not sell at the same price. If their prices are equal, then a disequilibrium must exist.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Rebello's preferred stock pays a dividend of

Q4: Goode Inc.'s stock has a required rate

Q5: Stocks A and B have the following

Q5: Founders' shares are a type of classified

Q6: Which of the following statements is CORRECT?<br>A)

Q7: Stocks A and B have the following

Q16: According to the basic DCF stock valuation

Q24: When a new issue of stock is

Q49: A stock just paid a dividend of

Q74: The preemptive right is important to shareholders