Multiple Choice

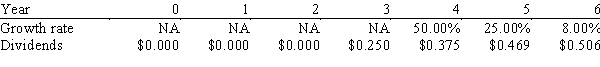

Agarwal Technologies was founded 10 years ago.It has been profitable for the last 5 years,but it has needed all of its earnings to support growth and thus has never paid a dividend.Management has indicated that it plans to pay a $0.25 dividend 3 years from today,then to increase it at a relatively rapid rate for 2 years,and then to increase it at a constant rate of 8.00% thereafter.Management's forecast of the future dividend stream,along with the forecasted growth rates,is shown below.Assuming a required return of 11.00%,what is your estimate of the stock's current value?

A) $ 9.94

B) $10.19

C) $10.45

D) $10.72

E) $10.99

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Which of the following statements is CORRECT?<br>A)A

Q60: The Isberg Company just paid a dividend

Q62: Wall Inc.forecasts that it will have the

Q64: Francis Inc.'s stock has a required rate

Q65: Reddick Enterprises' stock currently sells for $35.50

Q66: You have been assigned the task of

Q67: Huang Company's last dividend was $1.25.The dividend

Q78: An increase in a firm's expected growth

Q80: If D<sub>0</sub> = $1.75, g (which is

Q130: For a stock to be in equilibrium,