Multiple Choice

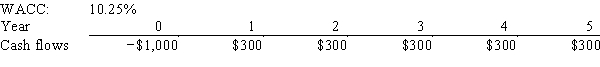

Harry's Inc.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that if a project's projected NPV is negative,it should be rejected.

A) $105.89

B) $111.47

C) $117.33

D) $123.51

E) $130.01

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The NPV and IRR methods,when used to

Q8: Because "present value" refers to the value

Q15: The internal rate of return is that

Q33: Datta Computer Systems is considering a project

Q36: Sexton Inc.is considering Projects S and L,whose

Q40: Cornell Enterprises is considering a project that

Q41: Simms Corp.is considering a project that has

Q62: Which of the following statements is CORRECT?

Q101: Which of the following statements is CORRECT?<br>A)

Q102: If you were evaluating two mutually exclusive