Multiple Choice

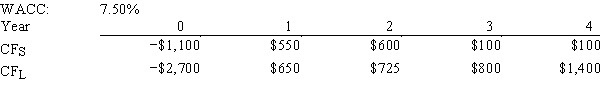

Tesar Chemicals is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV,how much,if any,value will be forgone,i.e.,what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

A) $138.10

B) $149.21

C) $160.31

D) $171.42

E) $182.52

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The internal rate of return is that

Q24: Normal Projects S and L have the

Q40: Cornell Enterprises is considering a project that

Q41: Simms Corp.is considering a project that has

Q43: Lasik Vision Inc.recently analyzed the project whose

Q45: Mansi Inc.is considering a project that has

Q47: Warr Company is considering a project that

Q49: Masulis Inc.is considering a project that has

Q50: Four of the following statements are truly

Q62: Which of the following statements is CORRECT?