Multiple Choice

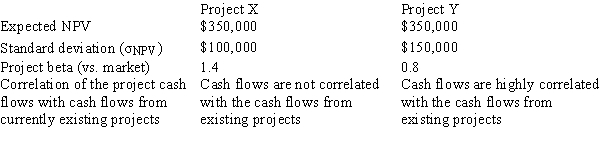

Taussig Technologies is considering two potential projects,X and Y.In assessing the projects' risks,the company estimated the beta of each project versus both the company's other assets and the stock market,and it also conducted thorough scenario and simulation analyses.This research produced the following data:

Which of the following statements is CORRECT?

Which of the following statements is CORRECT?

A) Project X has more stand-alone risk than Project Y.

B) Project X has more corporate (or within-firm) risk than Project Y.

C) Project X has more market risk than Project Y.

D) Project X has the same level of corporate risk as Project Y.

E) Project X has the same market risk as Project Y since its cash flows are not correlated with the cash flows of existing projects.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: If a firm's projects differ in risk,

Q13: The use of accelerated versus straight-line depreciation

Q29: Opportunity costs include those cash inflows that

Q32: Marshall-Miller & Company is considering the purchase

Q37: Your company,CSUS Inc.,is considering a new project

Q38: When evaluating a new project,firms should include

Q60: Typically, a project will have a higher

Q65: Dalrymple Inc.is considering production of a new

Q73: Which of the following rules is CORRECT

Q75: Which of the following statements is CORRECT?<br>A)