Multiple Choice

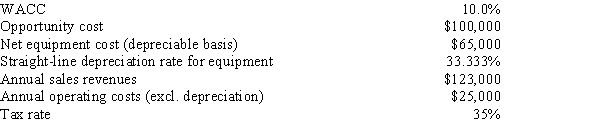

Sub-Prime Loan Company is thinking of opening a new office,and the key data are shown below.The company owns the building that would be used,and it could sell it for $100,000 after taxes if it decides not to open the new office.The equipment for the project would be depreciated by the straight-line method over the project's 3-year life,after which it would be worth nothing and thus it would have a zero salvage value.No change in net operating working capital would be required,and revenues and other operating costs would be constant over the project's 3-year life.What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $10,521

B) $11,075

C) $11,658

D) $12,271

E) $12,885

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A company is considering a proposed new

Q29: Which of the following should be considered

Q30: Which of the following statements is CORRECT?<br>A)

Q40: Changes in net operating working capital should

Q42: Suppose Walker Publishing Company is considering bringing

Q52: Suppose a firm's CFO thinks that an

Q61: Which of the following is NOT a

Q68: Florida Car Wash is considering a new

Q70: The primary advantage to using accelerated rather

Q72: You work for Whittenerg Inc.,which is considering