Multiple Choice

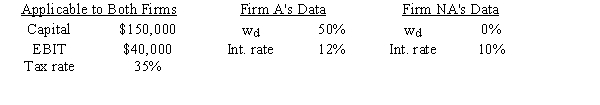

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical⎯they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e.,what is ROEA − ROENA?

A) 8.60%

B) 9.06%

C) 9.53%

D) 10.01%

E) 10.51%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Other things held constant,firms that use assets

Q3: Different borrowers have different risks of bankruptcy,and

Q9: Your firm is currently 100% equity financed.The

Q17: Other things held constant,which of the following

Q19: It is possible for Firms A and

Q44: Which of the following statements is CORRECT?<br>A)

Q53: Senate Inc.is considering two alternative methods for

Q57: Your uncle is considering investing in a

Q58: A firm's capital structure does not affect

Q72: A firm's CFO is considering increasing the