Multiple Choice

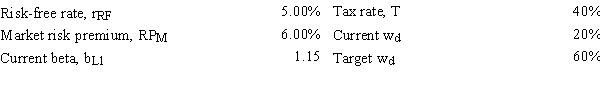

Dyson Inc.currently finances with 20.0% debt (i.e.,wd = 20%) ,but its new CFO is considering changing the capital structure so wd = 60.0% by issuing additional bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1 − wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity? (Hint: You must unlever the current beta and then use the unlevered beta to solve the problem.)

A) 4.05%

B) 4.50%

C) 4.95%

D) 5.45%

E) 5.99%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Other things held constant,firms that use assets

Q9: Your firm is currently 100% equity financed.The

Q19: It is possible for Firms A and

Q42: Southwest U's campus book store sells course

Q48: Confu Inc.expects to have the following data

Q58: A firm's capital structure does not affect

Q64: If two firms have the same expected

Q77: The Miller model begins with the Modigliani

Q81: Modigliani and Miller (MM)won Nobel Prizes for

Q84: The firm's target capital structure should do