Multiple Choice

On 1 July 2014 Waugh Ltd enters into an arrangement with a US bank-Big Bank-to borrow US$900 000.The term of the loan is 3 years with interest payable annually in arrears on 30 June at the rate of 10 per cent.The exchange rate information is: What journal entries are required in Waugh Ltd's books for 1 July 2014 and 30 June 2015 in accordance with AASB 121 (rounded to the nearest whole A$) ?

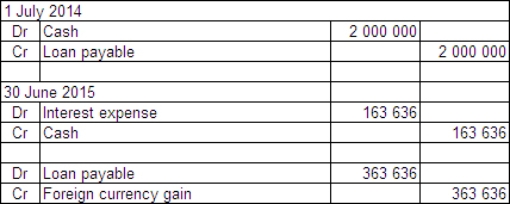

A)

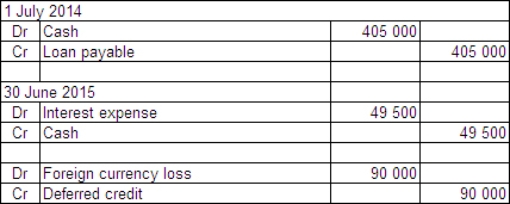

B)

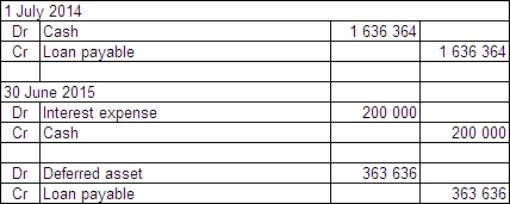

C)

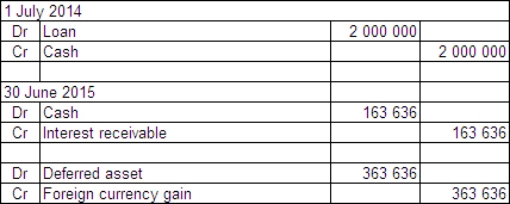

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The following data is provided for

Q9: Describe,with examples,the two tests of hedge effectiveness.

Q10: The effect of a fall in the

Q11: AASB 121 requires foreign currency transactions to

Q12: In selecting the appropriate foreign currency exchange

Q14: Examples of monetary items that may be

Q15: There are two broad categories of foreign

Q16: Which of the following is not a

Q17: Where the hedge arrangement completely eliminates the

Q18: AASB 123 Borrowing Costs defines a qualifying