Multiple Choice

On 1 July 2015 Jarrets Ltd borrows £500 000 from a British bank at an interest rate of 8 per cent,repayable in pounds sterling (£) and with interest due on 30 June each year.The term of the loan is 3 years.On the same date Fitners Ltd borrows A$1 million from an Australian bank at an interest rate of 10 per cent.The term of the loan is 3 years.Jarrets and Fitners decide to swap their interest and principal obligations on 1 July 2015.Exchange rate information is as follows: Both Jarrets and Fitners are Australian companies.What are the journal entries to record the swap for the period ended 30 June 2016 in Fitners Ltd's books (rounded to the nearest whole A$) ?

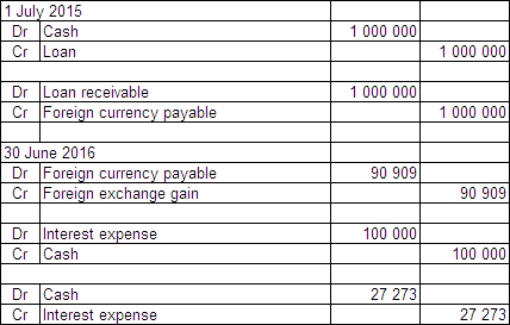

A)

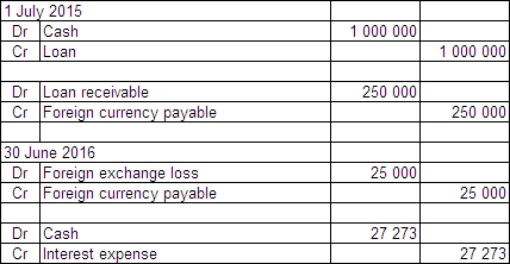

B)

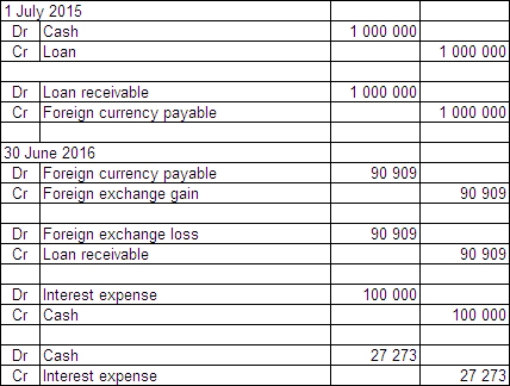

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Exchange differences recognised as borrowing costs and

Q34: The purpose of 'hedge accounting' is to

Q35: The effect of an increase in the

Q36: The Big Mac index is:<br>A) an indicator

Q37: AASB 121 defines an exchange rate as

Q39: Management may exercise its judgment to determine

Q40: Common examples of qualifying assets are assets

Q41: What are presentation and functional currencies?<br> How

Q42: Sure Ltd purchased goods for £210 000

Q43: Hedges cannot be designated and/or documented on