Multiple Choice

Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

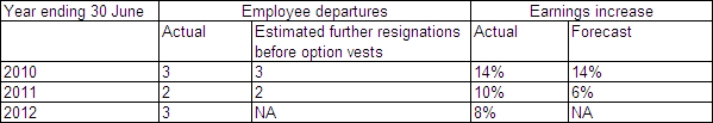

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2010?

A) $48 000

B) $49 333

C) $72 000

D) $74 000

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Which of the following statements is incorrect

Q48: When a good or service is acquired

Q49: Which of the following share-based payment transactions

Q50: AASB 2 requires all share-based payment transactions

Q51: On 1 July 2012 York Ltd (a

Q53: Southport Ltd grants 100 share appreciation

Q54: Market prices for share options granted to

Q55: Issue of shares in exchange for shares

Q56: If the arrangement in a share-based transaction

Q57: On 1 July 2012,Manchester Ltd granted