Multiple Choice

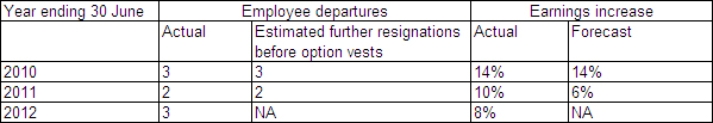

Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

The following information is available:

What action must Wigan Ltd take that is in compliance with AASB 2,if the option does not vest on 30 June 2012?

A) No action is necessary.

B) It must modify the terms and conditions of the option to allow the employees to benefit from the share-based payment transaction in future.

C) The equity account arising from the share-based payment transaction shall be reversed and credited to revenue.

D) The equity account arising from the share-based payment transaction shall be reversed and credited to liability.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following statements is incorrect

Q37: Which of the following items are not

Q38: Discuss the recognition principles required in AASB

Q39: In share-based payment transactions with cash alternatives,the

Q40: Explain why senior managers or executives have

Q42: On 1 July 2009,Windermere Ltd grants

Q43: If a grant of equity instruments is

Q44: To assist users of financial statements an

Q45: Liverpool Ltd grants 100 options to

Q46: If the fair value of the equity